blogs

KhataBook Triumphs: Overcoming SMEs' Financial Management!

India is slowly changing into a manufacturing hub. Previously, India was much of a service-oriented industry. It has valuable achievements in the service sector. Due to COVID-19 and Indo-China tensions, India is marching towards becoming a manufacturing hub. COVID 19 and the lockdown that followed it had created a devastating impact on the country’s economy.

The Information Technology industry faced struggles that lead to mass layoffs. Every businessman ranging from a store owner to an IT company founder faced economic crises. It was during that time, the Government of India came up with various schemes and tax relaxations to support Small and Medium-sized Enterprises. This motivated a lot of laid-off employees and others to start their own business.

Starting a business is not as easy as it sounds. A lot of heart and soul needs to be put in. One needs to have the willpower to face challenges. Of all the challenges, managing finances is the first challenge. Taking care of expenses, debts, credits, tracking payments can be painful without a strategic approach.

Can technology lend a helping hand to handle the finance management woes?

Imagine how peaceful it would be if technology can help in regulating some of the tasks related to Financial management. There are such ways where technology could be of great help. Finance management apps are proving themselves to be a boon to SMEs. KhataBook is one such financial app that gained huge popularity in less time. It currently has an active user base of 8 Million+ and 10 Million+ downloads. Let’s explore more about KhataBook.

What’s KhataBook and what it is capable of?

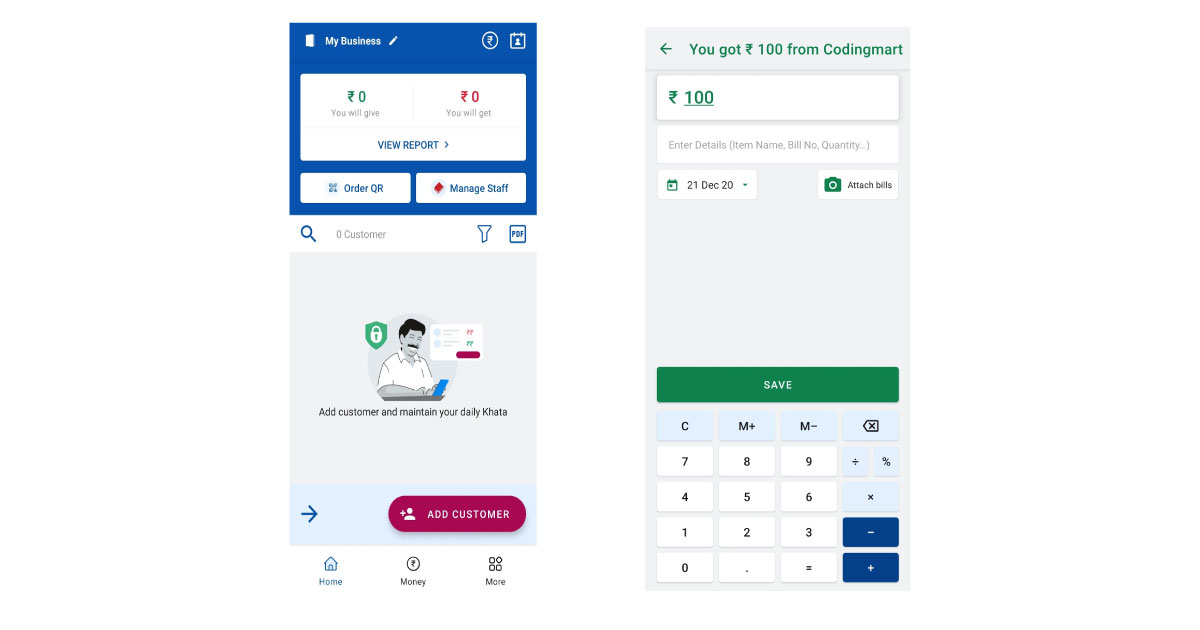

KhataBook, run by Kyte Technologies is a mobile app that lets you add your customers and the transaction details from where you can manage your finances easily. In short, KhataBook is a digital ledger. With KhataBook, you can store the contact information of your customers, attach photos of bills (if any), send and receive payment reminders, download monthly transaction reports, create business cards, play quizzes, etc. Isn’t that a huge list of interesting features?

Is KhataBook a common man’s cup of tea?

The short answer to the above question is, Yes! You need not need a doctorate of philosophy to use the app. The app has a simple User Interface (UI) that can be used by a common man with basic English knowledge. All the options and features are intuitive and user-friendly. No option will play hide and seek and they are named in simple English. Hence, just basic knowledge and understanding of English will be adequate to use KhataBook.

How to do’s:

- Adding a New Customer

Maintaining customer data and the addition of new customers through conventional methods is no more fruitful. It is a never-ending story. So, storing them digitally will make it easy to retrieve and process customer data, no matter how old it is. Adding a new customer is very easy.

On the lower right corner of the App, there’s a button named “Add customer“. Click on that and you’ll be prompted to give permission to add your contacts directly so that you can select your customer quickly if he is a contact of yours. Else, you can manually enter the name of the customer and his mobile number. That’s it!

- Adding bills and transactions

Often, your wallet or the cash drawer gets filled with a heap of bills. In case there is any dispute with a customer or if you need to find out the transaction details of a customer, you will face huge difficulty in finding the right bill among the other bills. With KhataBook, there are no such worries.

Once you have added a customer, adding the bills and transactions can be done in a tap. Tap the name of the customer and enter the amount you got or the amount you gave. Add the date and photo of the bill/transaction if needed. That’s the end. You can automatically set how to get reminders and when.

- Making and receiving payments

Payments are the deciding factors of success in business. Punctuality in payment is the success mantra for any business. KhataBook has a one-stop solution for that.

Go to the contact that you are willing to pay and choose the payments option. Add your bank account and then enter the other details. Boom! You are all set to send and receive payments and the money will directly be added to your account.

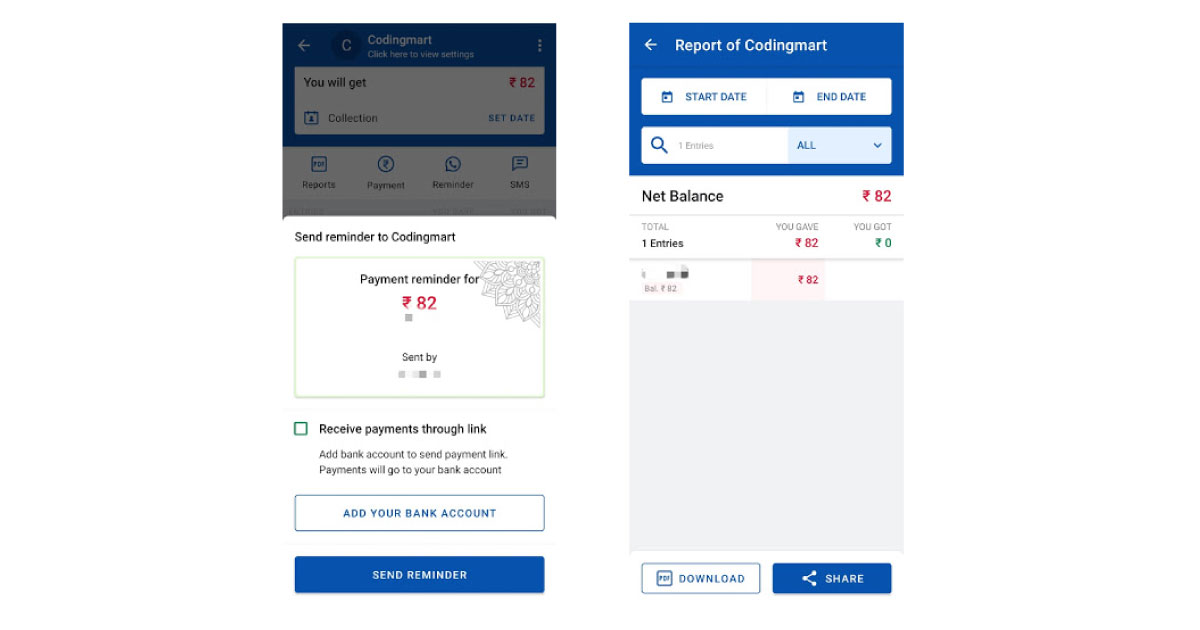

- Sending Payment reminders

While running a business, there are high chances that you may forget to pay someone that you owe. You may also forget to ask your money from someone else. With KhataBook, there are no such worries. You can send payment reminders as SMS, through WhatsApp or by any other means. That’s cool, right?

You can easily send payment reminders just by choosing a contact and then reminders. You can send the reminder via WhatsApp or SMS. If you wish, you can directly get the payment through the reminder link. You can also set a collection date by clicking on the set date option for the contact. By doing so, a payment reminder will automatically be sent to the concerned customer before a day itself.

- Downloading reports

There are chances that you may need to submit either all or part of your transaction details to an authority or your partner when needed. It will be difficult to give the reports as hard copies to multiple people. KhataBook eases the process by letting you download the transactional and payment reports.

On the home page, there will be an icon named PDF on the top right above the list of contacts. Just a tap on that will generate a PDF of your transactions. You can then share your PDFs with your team or anyone else easily.

The cherry on the cake:

Sometimes, there is a miscommunication of your bank details or your mobile number and the customers may pay money to someone else rather than paying you. Payment apps have introduced QR code to solve this problem and make transactions easy. If you have Paytm or Google Pay or PhonePe, you will have a QR code. They ease the process of making payments and customers find them really useful. But, they accept the payments only from their respective apps. That’s a drawback for businesses as we cannot expect our customers to have exactly the same app that is supported by the QR code. KhataBook has cracked this nut!

You can order for a QR code in a tap from the home page. A QR code will immediately get generated if you have already linked your bank account. The greatest attraction is that the QR code supports payments from multiple apps such as PhonePe, Google Pay, etc. It facilitates users with different payment apps and UPI’s to pay by scanning a single QR code.

With all the offerings as stated above, KhataBook seems to be a promising solution to the financial management woes. There are many features in addition to the above mentioned ones. KhataBook’s strategy has been simple – To keep the approach minimalistic in order to attract all range of users. There are other alternatives like OkCredit which are also performing well. With contemporary ideas and novel solutions to the challenges, Financial apps like Khatabook have created a revolution within a short span of time. The biggest success of KhataBook is its straightforwardness in design and user experience and phenomenal Television ads, that has enabled users from every nook and corner to use the app without any difficulty. We’ll know more about KhataBook’s promotion tactics in another blog. Stay tuned!